1. Check out the individual market trends online using Trulia or Zillow

This is a simple way to analyze any real estate market, and you can actually get super granular and zoom into more defined neighbors to do you own specific rent/buy calculations. Zillow and Trulia do not provide up-to-the-minute data like a Real Estate Agent but you can get some preliminary information to start your search. I highly recommend getting connected with a real estate agent.

Diving a bit further into the data it shows that the Las Vegas market is growing like most real estate markets in the US have been growing over the past few years. So while you wouldn’t be buying at the bottom of the market, the data is pretty compelling that buying a house is more affordable than renting – even if you only live in the place for 2 years.

2. Determine how long you are going to live there (it can be less than 5 years)

MYTH BUSTING TIME. Some say that you should ONLY buy a house or a condo if you are going to live in it for at least 5 years. This is just plain wrong! I think it makes sense to buy even if you are only going to live in a place for 2+ years in some markets.

And even if once you do all of the calculations that say you should be renting instead of buying, buying probably still makes more sense. Who knows, maybe you will end up living your city longer or you could keep your home and rent it out if you have to leave. Always lean towards buying a home if the numbers work.

3. Determine your potential down payment (it doesn’t have to be 20%)

ANOTHER MYTH: Too many people wait to save up 20% before buying a home. You don’t need 20%. After I had a client having only $200.26 in their bank account, I finally had helped her save up a decent amount of money to afford at least a 3% down payment with some additional padding for an emergency fund.

Yes, she only put 3% down on a condo and she bought as quickly as she could because she was certain that prices were going to keep going up. Yes, she had a lot of advantages buying when the market was still level, but if she had waited one year until she had 20% saved then she would have missed out on at least $125,000 in growth.

The reason she felt comfortable doing this was because she was confident in her income growth in the future. Think careful if your job is secure and if you can afford to buy a home (3% down payment + 3 months of expenses saved + stable job). Once she had those three locked down, she went searching for a property immediately.

4. Get pre-qualified for a mortgage before decided whether to rent or buy

This may answer the question for you. It’s a lot harder to get a mortgage now after 2008 mortgage crisis and even if you have awesome credit and a great job, you still might not get approved. It’s just weird sometimes. So I recommend that you contact us first and see what kind of mortgage you can pre-qualify for. Then you can see what a bank is willing to lend you and at what rate.

ALWAYS SHOP AROUND. Just some simple shopping and calling around for 30 minutes will help you make sure you are making the best decision and not settling for the first person you talk with.

I KNOW FOR A FACT that a lot of people don’t shop around for mortgage rates and just use the bank they bank with. This is a big mistake, especially if you bank with one of the big banks because they tend to have the strictest requirements and the highest rates AND fees.

Getting pre-approved will also help you best leverage the mortgage calculators because you will have specific rates to use. One mistake a client of mine made was assuming he had great credit and that he could get the best mortgage rates that are published online. There is always a catch to those rates and they are typically the lowest rate possible they could offer, but for some reason with an 817 credit score I couldn’t get them? If you haven’t yet, you should check out your credit score.

Note: Mortgage rates still remain close to historic lows so if you are considering buying a home in the next few years I would recommend doing it as soon as possible. Rates will go up and so buying any home will cost you more money.

5. Check the two best free rent vs. buy calculators

So what about the popular rent vs. buy calculators? We tried 7 different rent vs. buy calculators (each with their own methodologies) and the ALL TOLD ME TO RENT. Did I listen? Nope.

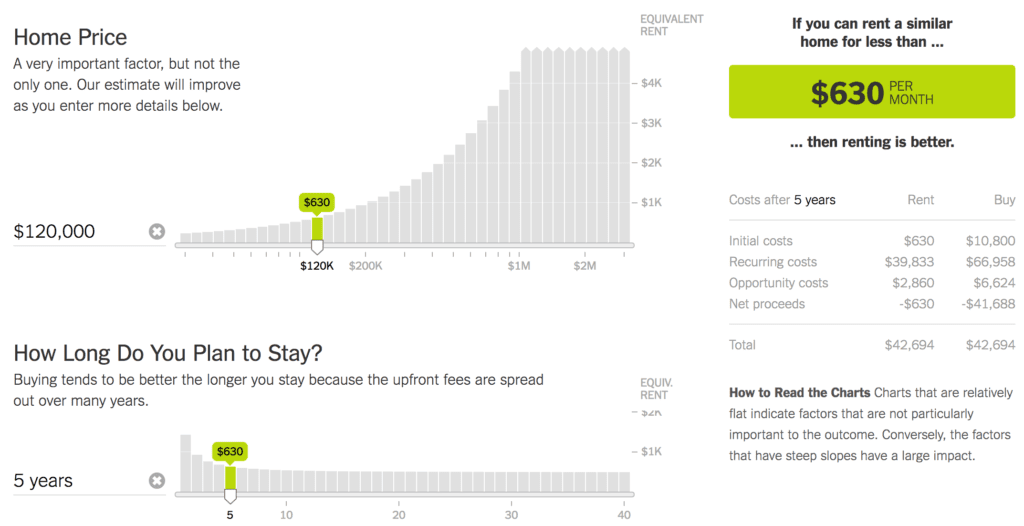

But they are worth checking. My two favorite free rent vs. buy calculators from Zillow and My App. Let’s check out the results below (making a some assumptions about salary as a policeman and using the average home price + 20% to give him some flexibility!)

New York Times Rent vs. Buy Calculator – Buy!

Zillow Buying vs. Renting Calculator – Buy!

We’ll there you have it. You should definitely be buying in Las Vegas.

FYI: It’s a no brainer to buy a multi-family home and renting part of the space where you live. There are some properties for sale in the Las Vegas market that have 2-4 units, so renting one out and putting that rent towards the mortgage makes buying an even better decision.

Happy house hunting!