When you check your credit score, you may have wondered WHY your score is different depending on where you check it. Here's why!

These 3 numbers have a impact on your life, from your ability to get a car loan or a mortgage to your chances of being denied an apartment or even a job? This is your credit score.

If you haven’t thought about your score until now, you need to start tracking it. After all, there are plenty of tools (both free and not free) for doing so.

First, let’s talk about what exactly a credit score is.

Credit bureaus

Since its creation in 1989, the FICO® Score has been the most commonly used assessment of creditworthiness. FICO® Scores are generated by a proprietary scoring algorithm, which empowers lenders to make informed decisions about risk and protects borrowers from unfair bias. This is why FICO® is considered the industry standard.

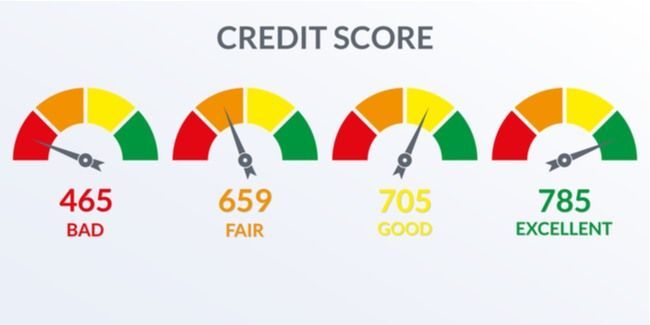

The base FICO® Score range is 300-850. Higher is better and anything above 600 is generally considered “fair.” Lenders equate your score with the level of risk they’d take by extending credit to you. A higher score means lower risk, better terms and vice versa.

This is why your credit score is so important, not only for credit approval but also for things like your credit limit and the terms of the loan.

The last thing you should know about credit scores is that, while FICO® Scores are used by the majority of lenders, there are also alternatives to the FICO score.

For example, some companies base its credit scores on the VantageScore model. Whichever model you or your lenders use, your credit score is actually three different scores, each based on your credit reports from the three bureaus (Equifax, TransUnion, and Experian).

As mentioned above, your credit score may vary slightly depending on the credit agency it comes from and the scoring algorithm used.

When you apply for credit, a lender may use a specific score (such as FICO) or an average of your various scores (FICO & Vantage).

So, focus on what you can control: Factors such as your length of credit and payment history and your credit utilization. If a crisis causes your score to go down, you can rebuild it in the same way you would originally create and maintain good standing.

According to some, your FICO summarizes your credit history…based on your financial decisions. As mentioned above, that history is reflected on your three credit reports.

Here are the most common factors used in credit score algorithms:

This is when you apply for a credit card or other type of loan and the lender pulls your credit report as part of the decision-making process. A hard inquiry usually lowers your score, so the more inquiries you have, the bigger the impact.

They also remain on credit reports for about two years, so be mindful and strategic when you need to apply for new credit accounts.

It’s good to have at least a few accounts (but not too many) and variety of account types is also important. Lenders want to see that you’ve used different types of credit without problems.

Also known as your balance-to-limit ratio, this is simply the percentage of your total credit limit in use at any given time. 30% or below is the target.

Higher percentages signal to lenders that you’re having trouble paying off your cards or spending more than you make, both show potential risks.

These consist of a range of “red flags” from late bill payments to credit accounts in collection and bankruptcy filings. These blemishes can stay on your report for up to a decade, so try to avoid those at all costs.

One easy way to avoid late payments is to sign up for autopay on all of your accounts, from utilities to credit cards.

Paying your bills on time is one of the most important ways to build and maintain a good credit score. This isn’t limited to debt payments either. Late payments to a utility or cell phone account can also lower your score.

After reading this article, you’re probably curious about your own scores and credit history. Here’s where you can find them:

Federal law entitles you to a free annual report from each of the three major reporting agencies. However, this doesn’t include a free credit score.

To obtain your score from TransUnion, Experian, or Equifax, you have to sign up for one of their monthly subscription plans. These range in price from $16.95-$24.95/month.

It is a good idea to get an idea of your credit scores and what is on your credit report so when the time arises to apply for something you aren't shocked at the score you see.

We can help if you are planning to buy a home in the future, let's get you a mortgage credit report, and a mortgage plan in place.

How much do I qualify for? (Get the App) See what you qualify for!