[SAVE THIS CHEAT SHEET!!]

This will come in handy while navigating going forward in 2024...

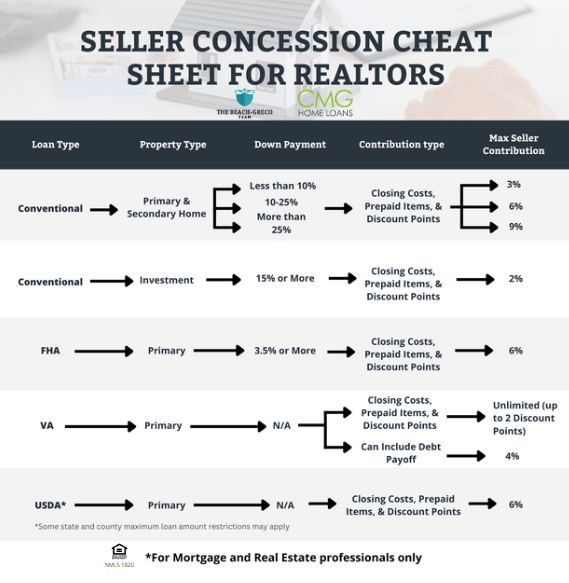

Creative ways to use excess seller contributions

While seller contributions are limited to actual closing costs, you can constructively increase your closing costs to use up all available funds.

Imagine the seller is willing to contribute $7,000 to buyer closing costs but they only add up to $5,000. That's a whopping $2,000 is on the line of unused money. We don't want to leave that on the table!

In this situation, ask your lender to quote you specific costs to lower the rate. You could end up shaving 0.125%-0.25% off your rate using the excess seller contribution.

You can also use seller credits to prepay your homeowners insurance, taxes, and sometimes even HOA dues. Ask your lender and escrow agent if there are any sewer capacity charges and/or other transfer taxes or fees that you could pay for in advance. Chances are there is a way to use all the money available to you.

You can even use seller credit to pay upfront funding fees for government loan types like FHA.

Use seller contributions for upfront FHA, VA, and USDA fees

All government-backed loan types allow you to prepay funding fees with seller contributions.

FHA loans require an upfront mortgage insurance payment equal to 1.75% of the loan amount. The seller may pay this fee as part of FHA seller concessions. However, the entire fee must be paid by the seller. If you use excess seller credit, but it's not enough to cover the entire upfront fee, then you cannot use the funds toward the fee.

VA loans allow the seller to pay all or part of the upfront fee (2.3%-3.6% of the loan amount). The fee counts towards VA's 4% maximum contribution rule.

USDA requires an upfront guarantee fee of 2.0% of the loan amount. The buyer can use seller contributions to pay for it.

What this means for you...

1- You will need a signed buyer broker agreement to protect yourself.

2- Time to hone in your skills and show your value.

3- Partner up with a lender that can help you navigate and succeed in today's market.

Reach out if I can help!

Aundrea

NMLS 333739

702-326-7866

info@aundreabeach.com

www.AundreaBeach.com